How to plan for Medicare supplement coverage requires a highly individualized discussion. We’ve been having these conversations for years, and thousands of individuals have trusted us to help them understand and choose the right supplement plan.

Starting roughly 90 days before your 65th birthday and extending for roughly 90 days after, it is time to sign up for Medicare. While you were working you bought a single type of coverage that had to work for everyone in the family. With Medicare, you will purchase exactly what makes the most sense for you.

IF you are planning to retire at 65, there are other parts to Medicare that you will need to make decisions about. Even if you don’t plan to retire at 65, everyone at that mid-60s birthday must enroll in Medicare. You can do that quickly by going to Medicare’s official website, medicare.gov. That is where you can register for your Part A Benefits. Part A covers all inpatient or in hospital admissions for care.

IF you are still working and have other benefits for healthcare that will continue after you qualify for Medicare you can waive signing up for other parts of the Medicare plan.

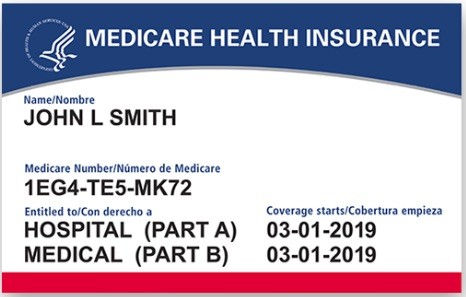

About 6 weeks after you sign up, you will receive your Official Medicare Card. Put this in a safe place if you are still working with other insurance benefits. It will be ready for you when you retire.

For those who have been on Medicare for a while, it is important to take advantage of the open enrollment period Oct. 15 – Dec. 7 so that you can change benefits if your health has changed or if there are newer products that will better cover your individual needs.

Let Professional Benefit Solutions help you sort through your options, regardless of your retirement status.

Recent Comments